By Richard Keech 2025-11-20

I attempt to debunk Topher Field’s opinion piece criticising renewables and the “bid stack system”.

What’s this about?

A video by Australian right-wing commentator Topher Field (also here) from October 2025 makes claims about how Australia’s electricity market works. I have seen this video doing the rounds. I think it needs to be debunked and seen for what it is – propaganda for the legacy fossil-fuel industry. It contains many untruths, part truths and distortions.

Caveat. In the video, Topher refers to the “bid stack system”. The bid stack forms part of the mechanism that implements merit-order pricing. I will refer to this by its correct name.

Claims

The video makes many claims which I summarise here:

- Merit order pricing is unfair and inefficient

- Gas-fired generation is cheap

- Coal + gas is reliable and affordable

- Battery generation is “stupendously” expensive

- Renewables and batteries are predominantly responsible for peak-price events

- The apparent low price of renewables is an illusion

- Renewables are unstable

- Coal-fired generation underpins the stability of the grid

- Renewables are the reason we have negative pricing

- Batteries charging from negative prices is unfair

- Gentailers game the system

- We need a better way of fairly contracting generators for their production.

Claim 1: Merit order pricing is unfair and inefficient

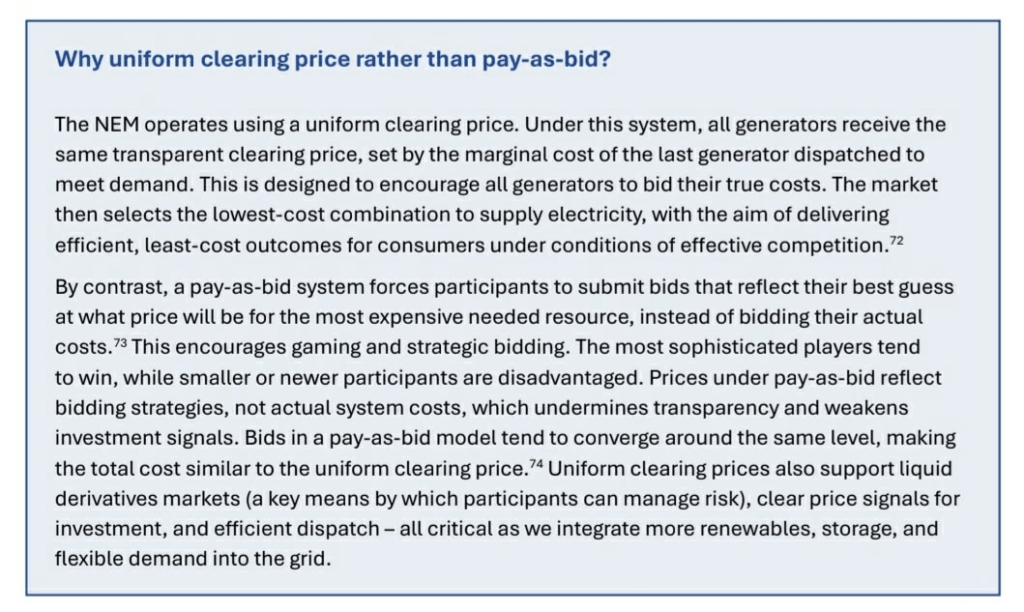

The central claim of the video is that the merit-order pricing mechanism gives unfair advantage to renewables. He recognises correctly that for each trading interval, all generators who get despatched are paid at the same rate as each other. However, Field overlooks that:

- the merit-order pricing system was around long before renewables were on the scene;

- the point of the bid stack arrangement is that the least amount of expensive generation sources is used, which keeps prices down. This is referred to as “economic dispatch”;

- in any trading interval, every kWh of energy is the same, regardless of the source. So paying all generators at the same rate in that interval is fair.

In the first scenario that he gives (timestamp: ~6min) where batteries set the price, he overlooks that very often it is gas that sets the price (see more in Claim 2, below).

The Wholesale Market Review expert panel recently considered the question of how payments are made. This is their view, from their draft report (pp 74), which I agree with.

Claim 2: Gas-fired generation is cheap

He claims and repeats (timestamp: 3:46, 4:50, 10:23, 20:46) that gas is cheap, and even suitable for baseload generation.

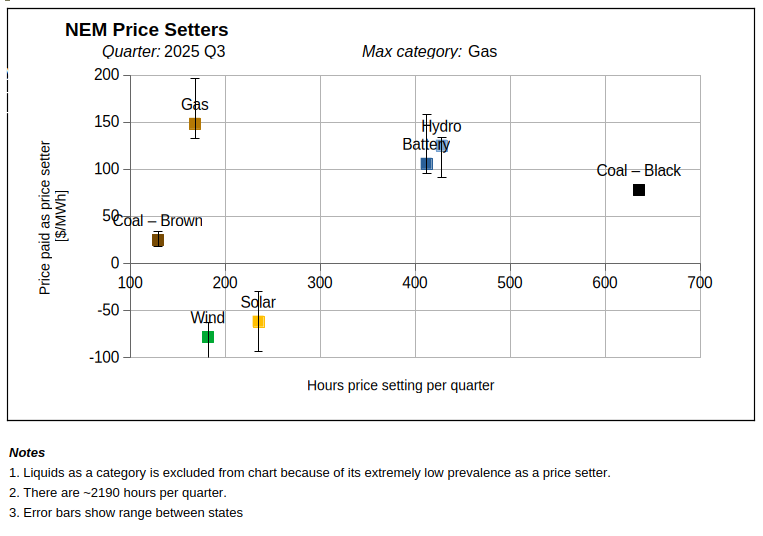

In reality, gas-powered generation is expensive and when supply is tight is often the form of generation which sets the high spot price.

Gas is way too expensive to be used for baseload generation. In our grid, this has long been the case.

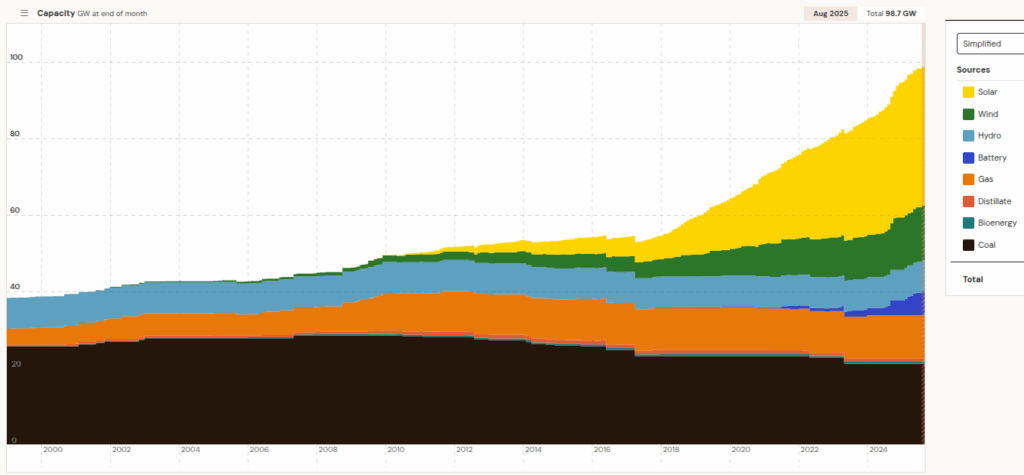

Price setters. To demonstrate this I have crunched the data from the Australian Energy Regulator which shows what generation categories set the prices in the NEM. This data looks quarter-by-quarter, back to 2014. My analysis of this data shows that in that time, gas was the dominant generation category for 29 out of the last 49 quarters (about two thirds) in the AER price-setting data. The next-highest generation category among the prices setters is hydro (11/29). Batteries have only been the dominant price setter in four quarters, and wind only once (2020 Q1).

For the latest quarter (2025 Q3), the spread of generation categories across all the hours in the quarter is show below.

Claim 3: Coal + gas is reliable and affordable

Cost of legacy coal generation. The levelised cost of coal-fired generation is relatively low for legacy generators because their capital investment was a long time ago and very often by state governments. It does not reflect the cost of new coal. Legacy coal and gas plants need replacing regardless. The levelised cost of energy for new coal generation, if there is any, is much higher. We need to compare generation sources on a fair basis.

Coal reliability. The framing in the video suggests coal-fired generation is highly reliable. This is simplistic and wrong. Coal plants frequently let us down. This has been well documented by Reliability Watch, and reported here. Also here and here.

Tripping. Individual generating units of coal-fired power plants are big (many hundreds of megawatts), and the way they fail tends to involve rapid unplanned events, colloquially referred to as ‘trips’. A trip of a coal generation unit takes a very large chunk of capacity offline in a heartbeat. The prevalence and impact of tripping by renewables is much less.

| There were 128 unplanned trips of coal-fired generators on the NEM in the spring/summer of 24/25 . Source: Reliability Watch. |

Calide. Special mention goes to the Calide C coal plant in Queensland. This plant exploded in 2021 (reported here), leading to a cascading black out affecting nearly half a million customers in Queensland. Repairs costing about $200 million took three years.

The 2024 analysis of the failure [here, and reported here] underscored how fragile these large machines really are.

So, it is just not true that the combination of coal and gas is an exemplar of affordable, reliable generation.

Claim 4: Battery generation is “stupendously” expensive

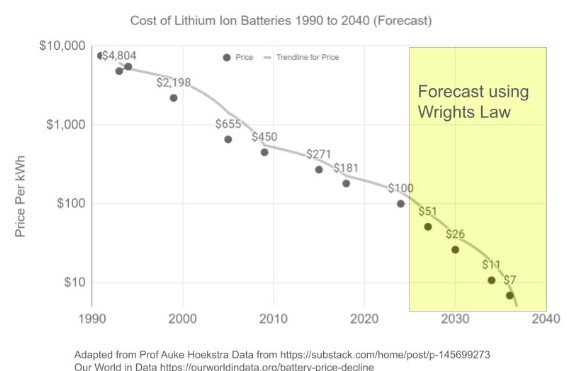

He claims that grid-scale batteries are “stupendously” expensive. Timestamps: 5:58, 12:26, 19:30. The reality is that the price paid for battery generation is now often lower than gas.

| “Average wholesale electricity prices fell significantly in the September quarter, helped by a surge in renewable energy production, and the rapid growth of battery storage that is displacing both gas and hydro in the critical evening peaks.” |

New data shows batteries are rapidly coming down the cost curve. So, if they are already cheaper than gas today, they will be much cheaper still in five years time.

Claim 5: Renewables and batteries are predominantly responsible for peak-price events

He talks about peak price events and the very high market-price cap. Then he suggests that it is batteries and renewable energy generators that are responsible when prices go this high. [Timestamps: 13:25, 21:18].

The reality is that, more often than not, it is gas-fired generators that set the price during peak-price events. [SOURCE?]

Claim 6: The apparent low price of renewables is an illusion

He claims that renewables are not as cheap as they may seem because the focus on renewables’ zero marginal cost ignores the significant capital cost. The problem with this line or reasoning is that:

- he doesn’t apply the same reasoning to cheap legacy coal-fired energy; and

- even when you take into account a full picture of the generation costs, firmed renewables are still preferrable.

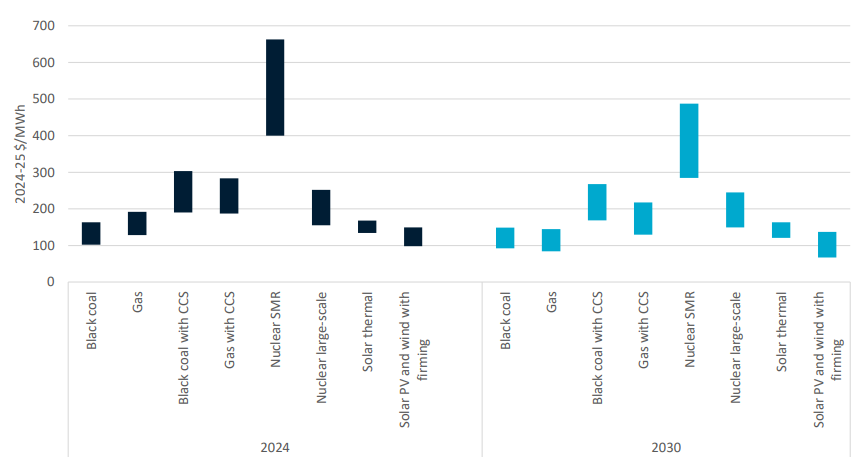

In energy, we use levelised cost of energy (LCOE) to express the overall costs of generation sources. In Australia, the benchmark study for cost of generation is the GenCost report, updated periodically. This report clearly shows that new firmed renewables are on par with new coal today, and in 2030 are expected to be the cheapest source of generation.

Claim 7: Renewables are unstable

He repeatedly claims that renewables are problematic because of their variablity. For example:

- “they just happen when they happen” [timestamp 5:05],

- “the price of instability” [timestamp 14:06],

- (paraphrasing) ‘coal is penalised by instability of wind and solar’ [timestamp 17:03],

- (paraphasing) ‘having more renewables makes power way less reliable and more expensive’ [timestamp 19:35],

- ¨renewables are worthless” [23:48],

- (paraphrasing)´renewables are destroying the efficiency of the whole grid'[23:58].

What is reliability? Solar and wind are variable sources of energy. However, they actually serve as very reliable contributors to the grid. Framing the intrinsic variability of the renewables as ‘unreliable’ fails to recognise that from the point of view of the market operator, reliability just means honouring your promises to the market. In other words, if a generator always dispatches when it is asked to dispatch, it is considered 100% reliable. Because solar and wind are predictably variable, their contribution to generation can be reliably forecast. The quintessential example of unreliable generation is a large coal-fired generator tripping off unexpectedly.

Strawberries. An analogy – the production of strawberries is seasonal. The market participants understand the normal seasonal variation in supply. Does that make strawberry producers unreliable? No. When strawberries are not available, we have other complementary fruits. So it is with renewables. Their variable pattern of generation is intrinsic, but that doesn’t prevent their orderly contribution to the market.

Claim 8: Coal-fired generation underpins the stability of the grid

He emphasises the importance of large spinning generators as a critical factor in grid reliability and correctly identifies how a minimum amount of inertia must be maintained for system strength. [timestamp: 14:55] He says “coal generators are the grid” to emphasise their centrality. [15:18].

Things are shifting. Firstly, we can get spinning inertia without fossil generation using synchronous condensors, aka ‘syncons’. SA now has four syncons (see here). Secondly, the market operator has been refining the rules about the minimum number of synchronous generators needed at any one time. As reported here, SA recently operated safely with only a single synchronous generator.

In addition, it is possible to get synthetic inertia from battery inverters (see here and here).

Claim 9: Renewables are the reason we have negative pricing

He identifies that market price can be negative at times when there is an abundance of solar power. He correctly identifies that this is generally undesirable, but that some participants, such as utility batteries can take advantage of this. He is concerned that coal generators are paying to generate when the price is negative [timestamps: 15:35, 17:03].

He claims that (paraphrasing) ‘coal is cheaper than it appears because it its forced to operate inefficiently’ [timestamp: 15:35].

The reality is that the biggest contributor to negative pricing is the lack of appropriate real-time price signals to retail customers with rooftop solar. Most solar inverters already have the tech to allow them to be commanded to curtail their generation when required. Thing are already happening to change the incentives and options for retail customers to change the way they participate. For example customers of Amber Energy can get real-time prices for energy, and also get their solar power automatically curtailed when it is appropriate to do so.

In the new dynamic electricity market, coal is showing that it is not fit for purpose. The fact is the low wholesale prices that renewables make possible is a new hard reality that is breaking the business model of the legacy coal-fired generators. This is not something that renewables need to apologise for.

Claim 10: Batteries charging from negative prices is unfair

The opportunity for batteries to charge at very low or negative spot prices is claimed to be unfair [timestamp: 18:40]. The excellent dynamic performance of batteries is actually of great help to the grid. Absorbing surplus is a good thing.

Claim 11: Gentailers game the system

He claims that large generators can game the system by sneakily taking coal-fired powerplants offline. This is one claim that I agree with. It is discussed here.

Claim 12: We need a better way of fairly contracting generators for their production

He wraps up suggesting that a better system for contracting generators is required. [timestamp: 23:27].

The wholesale electricity market is currently undergoing a broad review let by Tim Nelson. In its interim findings, the Nelson review very clearly finds that the fundamentals of the system are sound. There are no proposals to fundamentally change the market dispatch mechanism.

Further reading and sources

- Wright, M., 2012, “The merit order effect – actually, it’s a good thing”, RenewEconomy, here;

- Climate Club, 2024, “What is the merit order effect?”, YouTube, here;

- AEMO, “Dispatch Information”, here.

- McAuley, Ian., 2025-11-14, “Rising electricity prices have nothing to do with renewables”, Pearls and Irritations, here.

- Moreton, Adam., “Factchecking five Coalition claims about net zero, from power prices to the $9tn cost”, The Guardian, here.

- Vorath, Sophie, “Dutton blames renewables for rising power prices, but bills would be much higher without them”, Renew Economy here.

- Leitch, David, “How more wind and batteries push electricity prices down, even while gas prices stay high”, RenewEconomy, here.

- Simms, Rod, “There’s more to high cost of energy than the green transition”, here.

Leave a Reply